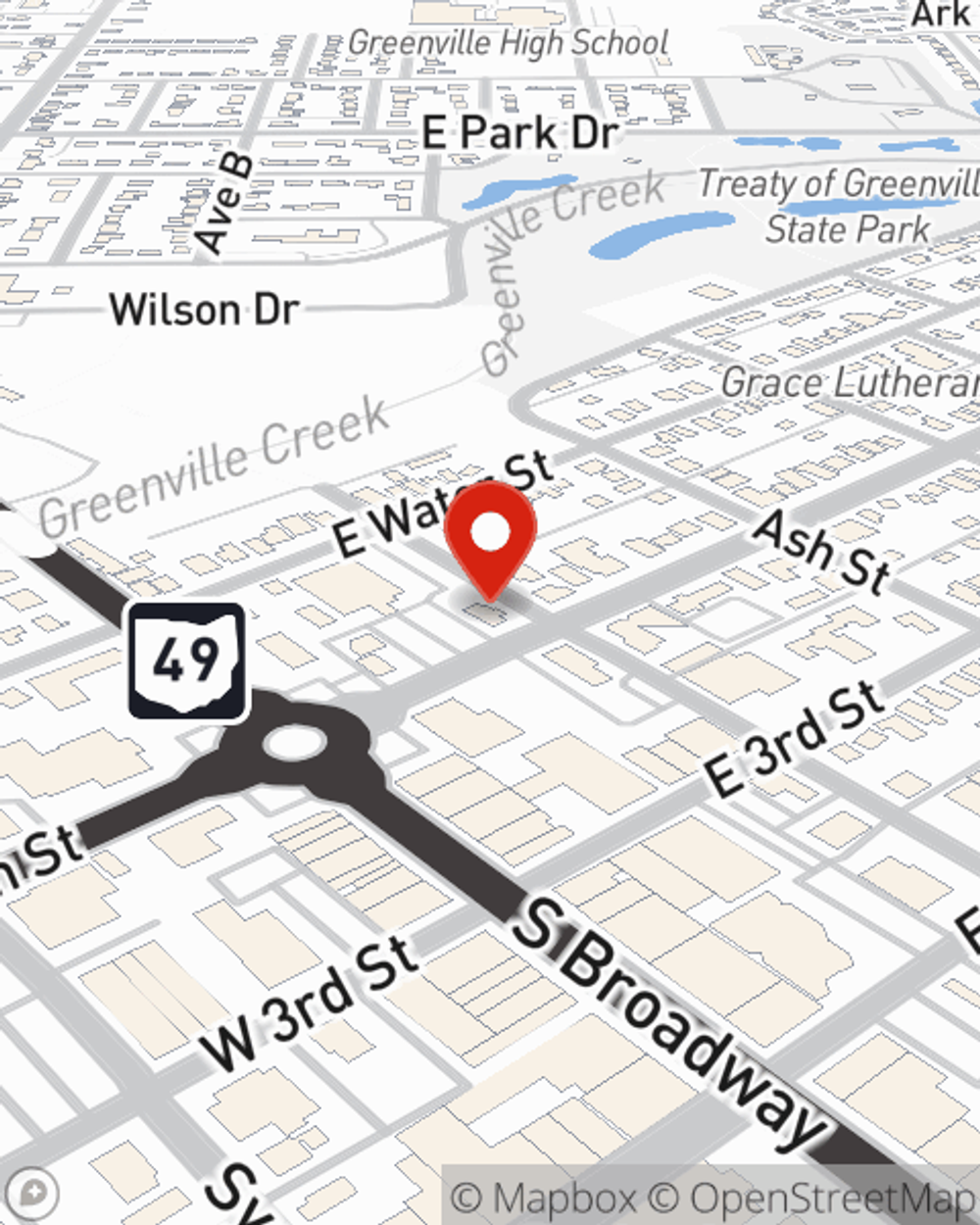

Business Insurance in and around Greenville

One of the top small business insurance companies in Greenville, and beyond.

Insure your business, intentionally

Your Search For Outstanding Small Business Insurance Ends Now.

Preparation is key for when a mishap happens on your business's property like a customer hurting themselves.

One of the top small business insurance companies in Greenville, and beyond.

Insure your business, intentionally

Protect Your Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Jim Gable is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such considerate service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Jim Gable can help you file your claim. Keep your business protected and growing strong with State Farm!

So, take the responsible next step for your business and reach out to State Farm agent Jim Gable to explore your small business insurance options!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Jim Gable

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?